MTN Uganda bets on music streaming as voice business slows

KAMPALA: Telecom firm MTN Uganda is betting on a new music streaming product to boost revenue and counter declining voice call sales, its chief marketing officer said in an interview.

The carrier, a unit of Johannesburg-listed MTN Group, is the largest in the East African country where it has a subscriber base of more than 10 million and competes chiefly with India’s Bharti Airtel.

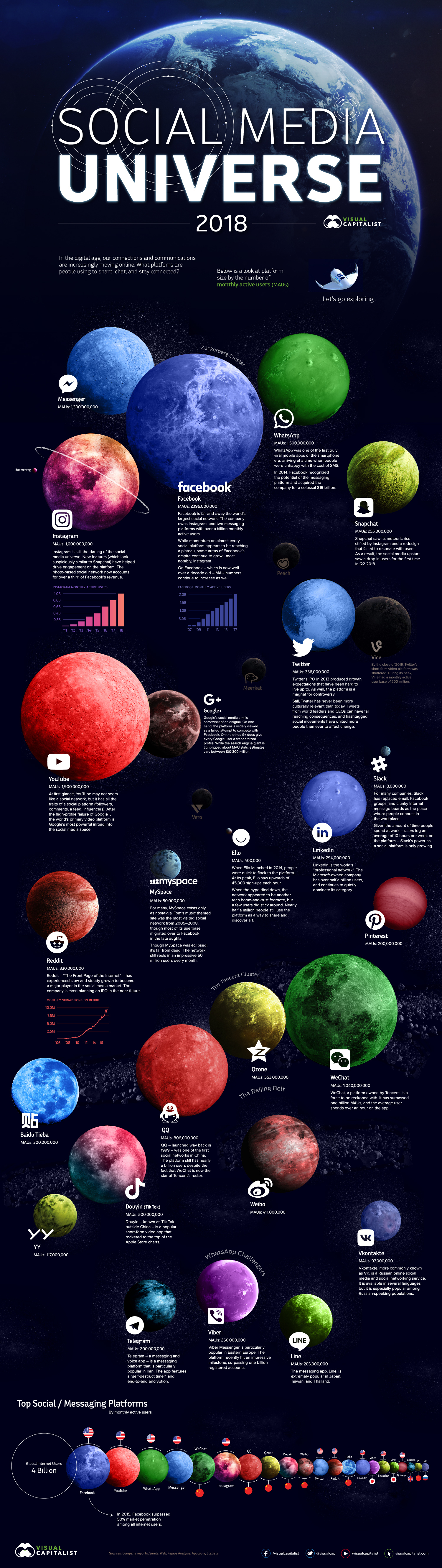

But last year its revenue per user stood at US$2.2, down from US$3.4 three years earlier, amid competition from Over the Top (OTT) call and chat services offered by American giants such as Google and Facebook.

“It’s a do or die,” Chief Marketing Officer Olivier Prentout told Reuters, describing the necessity to explore for new, unconventional sources of revenue and added that other partnerships may follow in sectors such as health and education.

“There was a time when the telcos could own everything. The voice, it was us. SMS, it was us. But with the internet coming suddenly there’s a lot of OTTs that are coming and playing in the sphere of the telecoms.”

MTN’s revenue from voice call business in 2017 declined 8.7 percent from the previous year while in contrast data sales jumped 23 percent in the same period.

Launched this week, the streaming service, jointly offered with industry minnow TIDAL, will compete in a market dominated by the likes of Spotify and Apple Music.

Low smartphone reach and piracy could also pose challenges, as well as the poor performance of a related service, online TV.

Prentout shrugged this off, saying he was confident the packaging of the service would guarantee its success. MTN and TIDAL will split the proceeds from music streaming sales equally.

“We are very optimistic… because of the way we constructed the product, which is an innovation. It’s an innovation in Africa, we are the first one to do it,” he said.

Payments will be made via Mobile Money, a cell phone-borne payments service widely used in East Africa which will eliminate the need for electronic bank cards that most users in Uganda don’t have. And data costs will be included in the subscription.

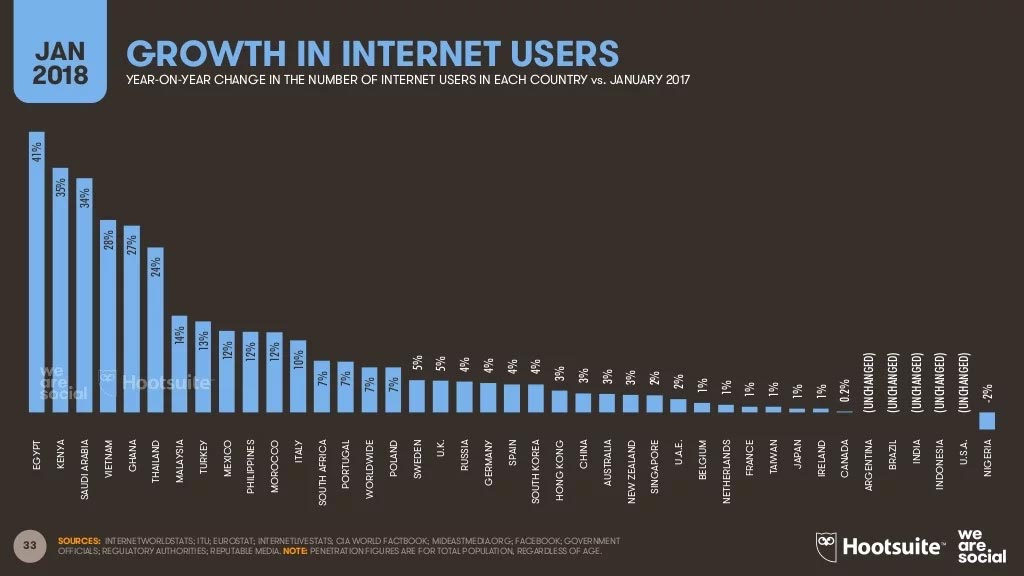

The number of internet users in Uganda has been growing rapidly and now stands at about 19 million out of a population of 40 million. The country’s youth-heavy demographics means appetite for music is plentiful.

Smartphone ownership, though, remains severely limited at 7 percent of all handsets in use, according to a report last year by global telecoms association GSMA. Internet speeds are slow for most, especially outside major towns.

Although the music streaming packages are data-inclusive, the starting package of 1,000 Ugandan shillings (US$0.2663) per day is still twice the cost of a typical data subscription product favoured by low-income groups like students.

Muhereza Kyamutetra, a Uganda marketing executive who has worked on digital media products said the product was timely.

“But how this is going to work in an environment of rampant piracy and poor internet quality, that may prove a teething problem,” he said.

(US$1 = 3,755.0000 Ugandan shillings)